How Healthy is Your Business?

You may think that your business is trucking along nicely and everything’s tickety-boo, but a few simple calculations will give you a better idea of how it’s doing.

I know your eyes are starting to glaze over at the thought of doing some calculations, but please stick with me because your business could benefit from you having more detail about it’s performance.

The ratios shown here will give you a picture of how your business is performing and alert you to potential financial issues. You can then review the areas of your business causing the issues to improve the financial stability of your business.

If you read the article and like the thought of knowing more about your business, but don’t want to do the ratios, then ask a bookkeeper, such as Building Blocks for Business, to give your accounts a WOF using these ratios.

So here are the ratios that you should be looking at:

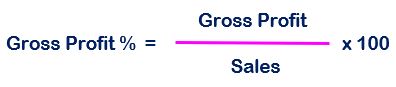

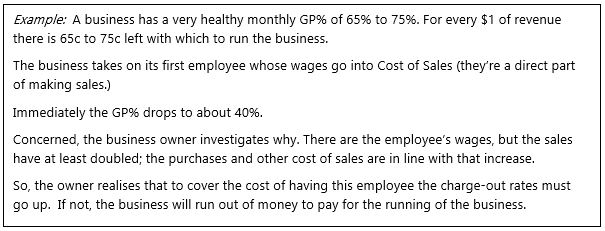

1.Gross Profit Percentage (GP%)

Gives you an over-view of the financial health of your business. Shows the percentage of sales revenue, after deducting the costs to make those sales, that is available to pay the costs of running the business. The higher the percentage, the more funds there are for running the business. A reduction in the ratio will indicate a problem with either the sales value, the cost of sales value, or both.

The values for this calculation are found in the Profit & Loss Statement.

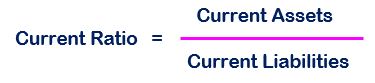

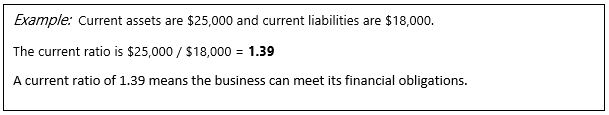

2.Current Ratio

How well your business can meet its short-term financial obligations; the short-term liquidity of the business. A ratio greater than 1.0 is ideal. A ratio below 1.0 means your business cannot pay all its current liabilities. A current ratio of 3.0, for instance, may indicate that there is spare money to be invested, or perhaps stock is too high.

The values for this calculation are in the Balance Sheet.

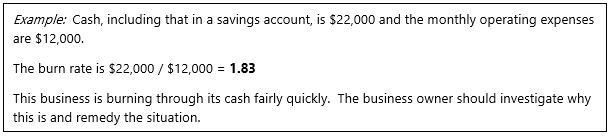

3.Burn Rate

This cashflow measure shows the rate at which the business is burning through its available funds. The higher the rate the shorter the time to burn through that cash.

The values for this calculation are in the Balance Sheet and the Profit & Loss Statement.

There you go; three quick and easy financial ratios to give you a snapshot of your business’s health.

If you track the ratios over time they will give you a better account. If you’re not a ‘numbers person’ then put the ratios into a chart/graph so you have a picture of how the ratios are trending.

There are more accounting ratios available and you may want to research these too.

Building Blocks for Business are experienced bookkeepers. Not only can we give your business a health check, we can do all your bookkeeping too!

Call us now on 021 771 555, or email tania@bbfb.co.nz